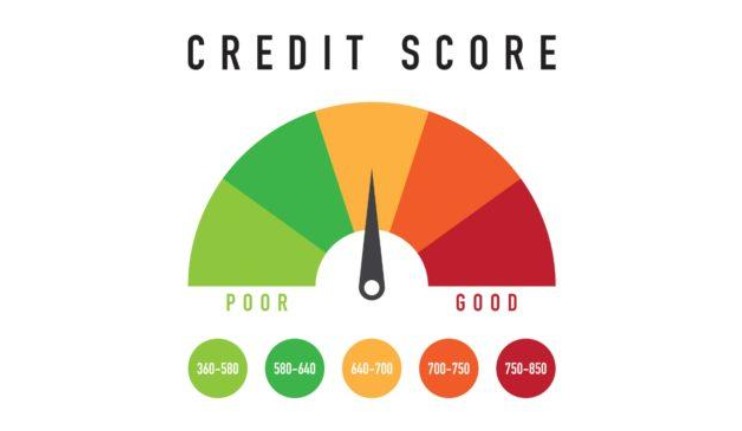

You should know that credit score is one of the most important factors when determining whether you should refinance. The higher your score is, the chances are higher that they will accept you for the best rates and terms you wanted in the first place.

The best way to understand everything about loans is by clicking here for additional information. At the same time, it can affect your ability to get loans, mortgages, and credit cards, among other things. Therefore, you should find ways to improve your credit score to help you reach the best terms and rates.

Tips for Improving Credit Score

- Credit History – Without a good history, it will be challenging for lending institutions to assess your spending and paying habits. Therefore, you will have a low credit score a result. This is a common problem among people new to the country and young US citizens. Still, you should take a few steps to help you throughout the process.

- Regular Payments – Handling your payments and accounts wholly and regularly is vital to highlight to lending institutions that you are a reliable and responsible borrower. Having well-managed and old accounts will drastically increase your credit score. That is why you should get a secured credit card, add money as a guarantee, and use it while paying for everything on time. You can boost your credit rating to obtain more significant amounts.

- Reduce Credit Utilization – You should know that credit utilization is a percentage you use for a credit limit. Therefore, if your limit is two thousand dollars and you used only a thousand, the utilization is fifty percent. Lenders’ lower percentage is a positive perspective, boosting your credit score result and history. We recommend keeping it under thirty percent, which is vital to remember.

- Instant Boost – As soon as you connect a current account to Experian, you will get the information on how well you use your money. Therefore, lenders will determine your situation by checking your financial behavior, including regular tax payments, Spotify and Netflix subscription, investment accounts, and savings. The summary of the above data can help you receive an instant boost, which will provide you peace of mind.

- Check Out for Mistakes and Errors – You should know that minor errors and mistakes, such as lousy addresses, can affect your score and lead to refusal. That is why you should check out your credit report to ensure everything is up to date and as accurate as possible. As soon as you notice a small mistake, you should talk with a provider and ask for a change. If you need help, we recommend you raise a dispute by visiting a credit bureau to determine the best action. For instance, if your report features negative information that happened under specific circumstances, such as losing a job or being in the hospital, you can contact Notice of Correction and explain the context beforehand.

- Monitor Potentially Fraudulent Activities – Suppose someone can access your details. That person can take a loan or credit in your name without you being notified. Therefore, as soon as you notice something wrong on your report, such as an application or payments you do not recognize, you should ask a support team to help you. That way, you can prevent potential issues from affecting your situation.

- Avoid Moving – Although it is not always possible to follow this aspect, you should keep in mind that lending institutions require additional stability in specific circumstances. Therefore, if you move from home to home frequently, that is an indication that you have financial trouble, such as paying bills or rent. That is why you should remain in your home for some time before applying for a significant loan.

- Keep Old Accounts Open – It is essential to show lenders that you can manage various credit accounts over a long period. Remember that scoring models will award you for mature and long-standing credit accounts.

Enter this link: https://www.govloans.gov/loans/cash-out-refinance-loan/ to learn everything about cash-out refinance.

- Credit Building Card – If your main goal is to boost your rating, we recommend you get a credit builder card to help you ensure the best course of action. In most cases, they have high-interest rates and low spending limits. Although you will lose a few points after applying for and getting your first card, you can build your score if you use it properly. These cards are highly effective because you will use them to spend small amounts and repay before the due to prevent missed payments and high-interest rates. Still, your parents can offer you their card you will not be able to use, but it will affect your rating. The main idea is that they should pay everything on time without maxing the ratio, which will help you as a co-owner.

Reasons to Improve Credit Score

When you apply for a particular loan, a lending institution will calculate your score and determine whether you should get the amount and at which interest rate and term. Everything depends on factors such as:

- Application details

- Credit report info

- Data they have on you, especially if you are a recurring customer

Remember that each lender comes with a specific calculation for ensuring the best score, depending on the lending criteria and information they can access. That is why Credit Bureaus can calculate scores for them and check out your history by making hard inquiries, which will momentarily affect your rating in the next few months.

Benefits of Improving Credit Score

Having a significant score means lending institutions will consider you a low risk for borrowing. Therefore, they are more likely to approve your application. The main reason is that your score indicates a history of managing your debt responsibly and making on-time payments.

- Higher Chances for Loan Approval – It doesn’t matter whether you wish to refinance a mortgage (refinansiere with crazzycricket) or get a car or personal loan because you will need a high score for approval. At the same time, you can choose a wide array of providers and offers, which will help you save money eventually.

- Reduce Interest Rates – Suppose lenders think that you are a lower risk. In that case, they will offer you better loans and interest rates on cards, ensuring the borrowing is more affordable than other options. A good score will allow you to get a low-interest loan, which is essential to consider.

- Better Car Insurance Rates – Apart from obtaining a loan, if you wish to spread the insurance payment over a year, the score will affect the interest charges you must pay for insurance premiums.

- High Credit Limits – As soon as you improve your score, you will get higher chances of borrowing high amounts. Generally, that way, you can achieve your goals fasters, meaning you can qualify for a mortgage or refinancing that will provide you additional cash you can use for home improvements, for instance.

How Long Should You Wait to Boost Credit Score?

Nothing happens overnight. You cannot fix your score in a few days, which is important to remember. Information about a new card or bank account will require at least a few weeks to appear on your report, while you will need a few months to notice relevant improvements.

Remember that missed payments, court judgments, and defaults will remain on your report for the next six years. Still, you should be as patient as possible and try to wait for new accounts to mature before they can help you boost a score. The main idea is to pay everything on time, which will increase chances of taking your score to a different level.

The impact of defaults and missing payments will reduce as time goes by, while credit bureaus will delete them from your report after six years.

Conclusion

You should know that each application for a loan will affect your score since the hard inquiries will reduce the rating. Therefore, you should wait for the lowest chance that the lender will reject you. Avoid applying to a few lenders simultaneously because that will strain your score.

Instead, we recommend you wait at least three months between applications, which is vital to remember. Finally, you should only borrow the amount you can afford because going over your capabilities will affect your everyday life.

When it comes to boosting your rating, it is important to remember that you should be as careful as possible to ensure you have stable income and finances. It is a simple as that.